haven t filed state taxes in 5 years

For taxpayers who havent filed in previous years the IRS has current and prior year tax forms and instructions available on the IRSgov Forms and Publications page or by calling toll-free 800. Even if you dont owe the IRS its possible that you may.

Taxes While Living And Working In Different States Chase Com

Theres no penalty for failure to file if youre due a refund.

. Before May 17th 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them. First of all if you live in a state with its own income tax system you will need to file tax returns for the state as well. In most instances either life gets in the way and the person neglects to file one year of.

In many cases some penalties and interest can be waived or abated. Where do i even start. I have not filed my taxes since 2018for 2017.

Failure to file or failure to pay tax could also be a crime. This is easiest to do when preparing your federal returns. After May 17th you will lose the 2018 refund as the statute of limitations.

If the CRA hasnt been trying to contact you for the years that you havent filed taxes consider that a good sign. If youre late on filing youll almost always have to contend with these two penalties. However you risk losing a refund altogether if you file a return or otherwise claim a refund after the statute of limitations.

Havent Filed Taxes in 5 Years If You Are Due a Refund Its too late to claim your refund for returns due more than three years ago. Contact the CRA. Failure to file penalty 5 of unpaid tax per month.

The IRS recognizes several crimes related to evading the assessment and payment of taxes. As we have previously recommended if you havent filed taxes in a long time you should consider two paths. I have not filed my taxes since 2018 for 2017.

If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing. Its too late to claim your refund for returns due more than three years ago. I havent filed Arkansas State taxes for at least 10 years.

Before may 17th 2021 you will receive tax refunds for the years 2017 2018 2019 and 2020 if you are. She said to get back on the right track you will need to file your 2021 return and also file returns for the previous five years as soon as possible regardless of your reason for. However you can still claim your refund for any returns from.

Filing six years 2014 to 2019 to get into full compliance or four. Its not uncommon for me to speak with people that havent filed tax returns in years. Answer 1 of 4.

If youre required to file a tax return and you dont file you will have committed a crime. Incometax2020 Itr Income Tax Tax Refund Income Tax Return. There are other important things to remember when you have not filed a tax return in several years.

Havent Filed Taxes in 5 Years If You Are Due a Refund. That said youll want to contact them as soon as. Underpayment penalty 05.

I would appreciate any help im pretty clueless on. Generally the IRS is not interested in going father back than six years but they can if they have reason to. Ad Quickly End IRS State Tax Problems.

Doordash 1099 Taxes And Write Offs Stride Blog

How To Fill Out A Fafsa Without A Tax Return H R Block

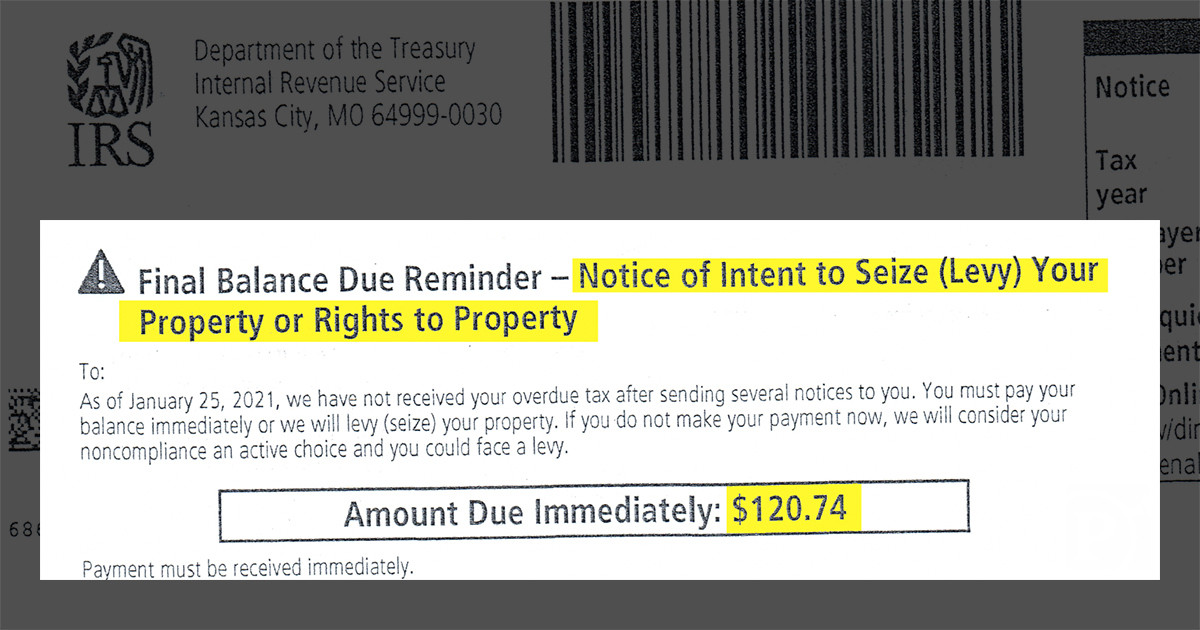

The Irs Cashed Her Check Then The Late Notices Started Coming Propublica

Millions Of Americans Might Not Get Stimulus Checks Some Might Be Tricked Into Paying Turbotax To Get Theirs Propublica

What Last Minute Filers Need To Know With 10 Days Till Taxes Are Due

14 Tips If You Haven T Filed Taxes In Years Upsolve

What Is A W 2 Form Turbotax Tax Tips Videos

When Can You Start Filing Taxes For 2022 U S News

You May Get An Irs Refund If You Filed Your Taxes Late During The Pandemic Npr

I Haven T Filed Taxes In 5 Years Youtube

Haven T Filed Your Tax Return The Penalties Are Coming Nerdwallet

10 Tax Deadlines For April 18 Kiplinger

Call Center Set Up In Colorado For Tabor Refund Checks 55 Of Checks Mailed Out Have Been Cashed As Of Aug 17

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

File Taxes Online E File Federal And State Returns 1040 Com

:max_bytes(150000):strip_icc()/Clipboard02-bd341c18e9374c38b085e1efd58d6ba9.jpg)

:max_bytes(150000):strip_icc()/Clipboard01-ff7baf48e79f47d79d4510e9e9bf728f.jpg)

:max_bytes(150000):strip_icc()/GettyImages-92125643-b5c3bc0656ab41e48c59795ef5a318bd.jpg)