utah food tax increase 2020

Since local option and county sales tax also apply to the sale of grocery food the combined sales tax rate is 3 throughout the state. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668.

Fooddelivery Local Business Elementor Template Kit By Puzzlerbox

This page will be updated monthly as new sales tax rates are released.

. On January 28 2020 Utah repealed the tax law changes discussed in this Alert before they took effect. This page lists the various sales use tax rates effective throughout Utah. A previous budget had proposed a 69 property tax increase to cover that budget increase but due to the last-minute cuts the exact tax rate had yet to.

Panguitch 09-011 100 Municipal Transient Room Tax Taylorsville 18-142 100 Municipal Transient Room Tax New tax Rate increase. Here are some of the highlights from the bill. The state sales tax on food is increased from 175 to the full 485 state rate.

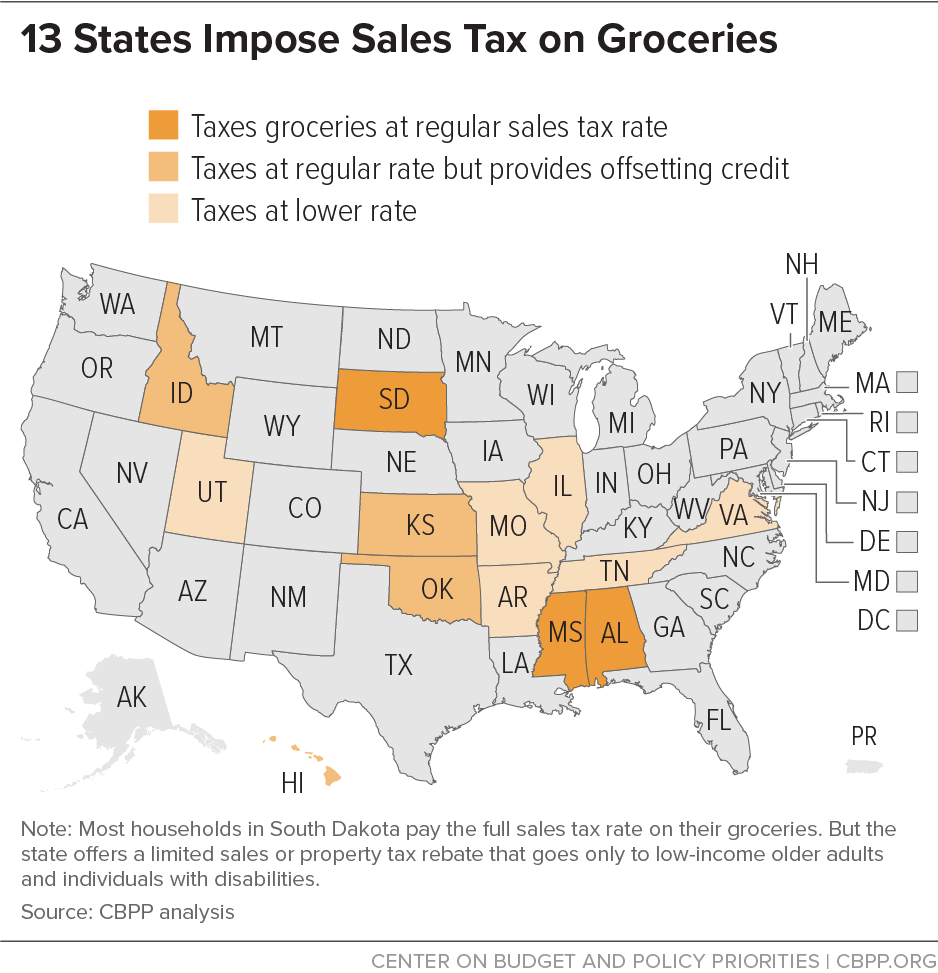

Over the past year there have been eleven local sales tax rate changes in Utah. Sales Use Taxes Created Date. Opponents say both changes will penalize low.

See Utah Code 59-12-602 5 and 59-12-603 1 a ii Pub 55 Sales Tax. 175 rather than 485. 2022 Utah state sales tax.

Heidi Rosenberg of Tooele who works in marketing said she signed the referendum on her way into the store because shes concerned about the impact of the sales tax increase on food from the current 175 to the full state rate of 485 despite a new grocery credit of up to 125 per person for low- and moderate-income Utahns. In addition to raising the current 175 state sales on food to the full 485 state rate the proposal would also impose sales taxes on gasoline purchases and on a number of services as first reported earlier this week by the Deseret News. Counties and cities can charge an additional local sales tax of up to 24 for a maximum possible combined sales tax of 835.

The list of services subject to sales taxes would include those provided by veterinarians tour guides. For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and other publications found here. Under the new tax rate that goes.

This graphic shows what this increase means to you. We appreciate all who have reached out and are grateful for the time that we have had to visit with each of you concerning the 2020 tax rate. Report and pay this tax using form TC-62F Restaurant Tax Return.

Under the Task Force plan grocery food would be taxed at the full 485 state rate plus applicable local. Utah State Tax Commission Subject. In a 2019 report Utah Foundation revealed that Utahs tax burden in 2016 was the lowest in 25 years at 10386 per 1000 of personal income.

If you have any further questions we are always happy to discuss. This referendum effort sought to repeal Utah Senate Bill 2001 titled Tax Restructuring Revisions which was designed to make changes to the state tax code. The proposal would increase the sales tax rate on unprepared food and food ingredients from 175 to 485 Its very hard for people.

The Utah County Commission recently voted to adjust property tax rates. Exact tax amount may vary for different items. Follow this link to view a listing of tax rates effective each quarter.

The decision to tax services has been lambasted by Utahns as has increasing the state sales tax on groceries from 175 to 485 plus local tax. The report also showed that in 2003 and 2004 Utah had the sixth highest tax burden in the. After proponents submitted signatures the state legislature voted to.

The following sales tax changes were made effective in the respective quarters listed below. First Quarter 2008 Changes. For details see Tax Alert 2020-0212.

Under the current tax rate a family spending that much on food are paying roughly 1804 a month in state and local food taxes or about 21648 a year. SALT LAKE CITY ABC4 News The Utah State Legislature Tax Restructuring and Equalization Tax Force is expected to make a decision Monday evening on whether a proposal that will increase the sales tax on food by three percent will move forward to the legislature. The restaurant tax applies to all food sales both prepared food and grocery food.

Grocery food is currently subject to reduced rate of state sales tax in Utah. For other states see our list of nationwide sales tax. The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes.

The Utah Changes to State Tax Code Referendum was not on the ballot in Utah as a veto referendum on November 3 2020. Utahns Against Hunger calculated the impact of the food tax hike for a family of four two adults and two school-age children spending 15030 a week on food under the USDAs low-cost food plan. State Local Option.

On December 18 2019 Utah Governor Gary Herbert signed SB 2001 the bill which cuts corporate and individual income tax rates imposes sales and use tax on various services repeals certain sales and use tax exemptions and. Bars and taverns in Utah are also subject to restaurant tax on food sales and beverages including beer and liquor. Tax Rate Changes Effective January 1 2020 Author.

According to the bill if passed it would increase sales tax revenue in the state by approximately 570 million and decrease the income tax revenue by 650 million. Restores the full sales tax rate on unprepared food. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply.

Egg Food Allergy Research Education

Sales Tax On Grocery Items Taxjar

Sales Tax On Grocery Items Taxjar

Utah Lawmakers And Community Members Want To End The Sales Tax On Food Items Kuer

What We Lose By Hiring Someone To Pick Up Our Avocados For Us Published 2020 Brooklyn Navy Yard Pleasure Way Civic Engagement

Utah Lawmakers Are Discussing An Increased Tax On Food Here S What That Means Kutv

States Can Thoughtfully Implement Grocery Tax Reforms To Help Families And Improve Equity Center On Budget And Policy Priorities

Food Stamps 2022 What Is The Income Limit To Qualify For This Benefit Marca

Utah Lawmakers Are Discussing An Increased Tax On Food Here S What That Means Kutv

116 Visual Content Ideas For Your Social Media Marketing Strategy Infogra Marketing Strategy Social Media Strategy Infographic Marketing Strategy Infographic

What Is The Tax Rate On Food In Utah This Lawmaker Wants It To Be Zero Deseret News

Food Models Agclassroomstore At Usu

Utah Lawmakers Are Discussing An Increased Tax On Food Here S What That Means Kutv

Treehouse Foods Nixes Company Sale But May Divest Segments Food Manufacturing

The Rules On Sales Taxes For Food Takeout And Delivery Cpa Practice Advisor

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

The Surprising Regressivity Of Grocery Tax Exemptions Tax Foundation