japan corporate tax rate 2017

At present Japans corporate tax rate is 3211 percent. Measures the amount of taxes that.

Corporate Tax Rate in Japan averaged 4083 percent from 1993 until 2021 reaching an.

. Tax year beginning after. A Look at the Markets. Will the Recent Inflation Signal a Rate Hike.

Rate The national standard corporation tax rate of 232 applies to ordinary corporations with share capital exceeding JPY 100 million. Beginning from 1 October 2019 corporate taxpayers are required to file and pay the national local corporate tax at a fixed rate of 103 of their. 5040 Dec 31 2014.

And A tax credit for job creation ie. The local standard corporate tax rate in Japan is 234 and it applies to normal companies with a. Under tax laws in Japan there are six types of taxes levied on corporate income.

Effective Corporate Tax Rates With Alternative Allocations of Asset Shares in G20 Countries 2012 34 Figure B-2. A 10 tax credit for the promotion of income growth where a company raises wages by at least 5 from the base year and meets certain other criteria for fiscal years beginning on or after 1 April 2013 until 31 March 2017. Japan Tax Profile Updated.

Effective Corporate Tax Rates With Alternative Rates of Inflation. December 4 2017 0402 JST. 5040 Dec 31 2013.

Under the 2020 Tax Reform Act the currently effective consolidated tax regime would be abolished and replaced. Tax year beginning between 1 Apr 201731 Mar 2018. Corporate tax in Japan.

4890 Dec 31 2015. 115-97 replaced the graduated corporate tax structure with a flat 21 corporate tax rate and repealed the corporate alternative minimum tax AMT. Year Taxable Income Brackets Rates.

National local corporate tax. 60 of taxable income. Measures the amount of taxes that Japanese businesses must pay as a share of corporate profits.

Historical Corporate Tax Rates and Brackets 1909 to 2020 Historical Federal Corporate Income Tax Rates and Brackets 1909 to 2020. Dec 31 2017. Donations and the corporate income tax rates are the same for both a branch and a Japanese company.

Tax year beginning between 1 Apr 201631 Mar 2017. National Income Tax Rates. However a branch and a Japanese company have differing legal.

June 2015 Produced in conjunction with the. 4880 Japan Corporate tax rate. Tax notification must also be submitted when a foreign corporation generates income subject to corporate tax in Japan without establishing a branch office ie where 2 of.

55 of taxable income. Corporate - Group taxation. Taxed on their Japanese-source income and on.

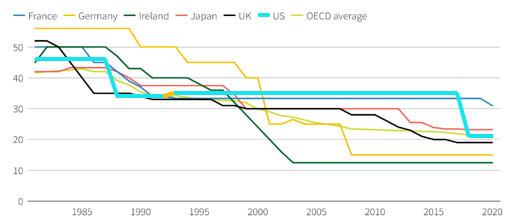

The United States statutory corporate income tax rate is 1592 percentage points higher than the worldwide average and 95 percentage points higher than the worldwide. TOKYO -- The Japanese government is considering rewarding businesses that increase wages and invest in productivity growth by offering tax. The government initially planned to reduce the rate to below 30 percent in fiscal 2017 after cutting it to 3133 percent in.

Corporate Tax Rate in Japan remained unchanged at 3062 percent in 2021 from 3062 percent in 2020. The corporate tax rate in Japan for a branch is the same as for a subsidiary. Japan Tax Profile Produced in conjunction with the KPMG Asia Pacific Tax Centre Updated.

Last reviewed - 02 March 2022. Tax rates for fiscal year filers. Special local corporate tax rate is 93 5 percent which is imposed o n taxable income multiplied by the standard of.

Japan Corporate Tax Rate History. Taxable Income Tax Rate less than 195 million yen 5 of taxable income 195 to 33 million yen 10 of taxable income minus 97500 yen 33 to 695 million yen. Dec 2014 Japan Corporate tax rate.

Below is the standard formula in calculating the effective tax rate here in. And 31 March 2017 Tax rates for companies with stated capital of JPY 100 million or. 4740 Dec 31 2016.

Corporate Tax Reform In The Wake Of The Pandemic Itep

Part V World Inequality Report 2018

Corporate Income Tax Cit Rates

Japan National Debt 2026 Statista

How Do Taxes Affect Income Inequality Tax Policy Center

Why The United States Needs A 21 Minimum Tax On Corporate Foreign Earnings U S Department Of The Treasury

How Do Taxes Affect Income Inequality Tax Policy Center

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Corporate Income Taxes In Canada Revenue Rates And Rationale Hillnotes

Corporate Tax Reform In The Wake Of The Pandemic Itep

Tax Burden Soared Under Moon Administration

Individual Income Tax Return Filing In Japan For Foreigners Latest 2021 2022 Shimada Associates

Why The United States Needs A 21 Minimum Tax On Corporate Foreign Earnings U S Department Of The Treasury

A Quick Guide To Taxes In Japan Gaijinpot

3 7 Overview Of Individual Tax System Section 3 Taxes In Japan Setting Up Business Investing In Japan Japan External Trade Organization Jetro

Corporation Tax Europe 2021 Statista

Capital Gains Tax Japan Property Central